PayPal is primarily for small business owners who accept credit card payments on a regular basis, as well as any new business that needs to accept credit cards. In these PayPal reviews, we\’ll take a look at what PayPal offers for business credit card processing.

For existing business owners interested in using PayPal to accept customer credit card payments, the content of this PayPal review is expected to cover the most important factors. PayPal has many services for business owners, and their range of services can be a little confusing if you\’re just starting to process payments.

What is PayPal?

PayPal has a commercial services division that allows businesses of all sizes to accept credit card payments. An important difference between PayPal and a merchant account provided by a credit card processor is that business owners must request funds to be transferred from their PayPal accounts to their bank accounts.

If a customer buys a product from the company using PayPal, the network will automatically send the funds to an external bank account, so there is no need to think about so many manual transfers. You can fund payments through your bank account, debit card, credit card, or PayPal balance.

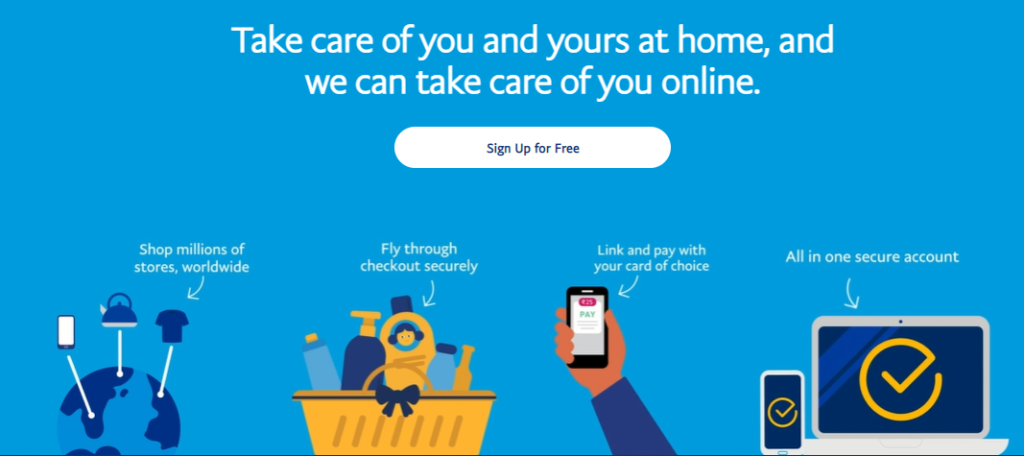

PayPal Business is easy to use and offers fundraising tools such as a donation button that can be added to any website, public payment links, a QR code generator, and a hosted donation page.

With the PayPal eCommerce platform, you can handle physical payments, services, eCommerce hosting, and hosting, or crowdfunding. Multiple Payment Methods PayPal offers you and other customers a variety of payment methods, such as debit, prepaid, and credit cards.

Some Interesting features of PayPal

One of the things that makes PayPal so impressive is the fact that the company has more to offer than just a fun online payment experience. In addition to accepting payments online, PayPal can also help with a number of other transactional transactions.

Another factor in PayPal\’s wide appeal is that, unlike the vast majority of merchant accounts or payment systems available, you can use PayPal as a unique payment gateway or as an option. PayPal\’s pricing is very straightforward, although payment processing costs are slightly higher than most traditional merchant accounts.

PayPal is accepted everywhere

You can then spend money from PayPal transactions anywhere PayPal is accepted online, or transfer funds to your bank account. The first thing you need to know about PayPal payments is that the funds of your transactions are deposited into your PayPal account almost instantly, so you can use the amount you earn anywhere on the web that accepts PayPal, or transfer funds directly to your account in the bank.

Store different currencies

You can also store multiple currencies in your PayPal account, make or receive payments in other currencies, convert your PayPal balance to another currency, and convert your balance to any currency.

A cashless in-store purchase feature

The PayPal app has a cashless in-store purchase feature that uses QR codes instead of relying on Near Field Communication (NFC) like Apple Pay and Google Wallet do. One nice thing about paying with PayPal is that, unlike Venmo, they don\’t need to install their mobile payment app; they just need a PayPal account. After downloading the app, you\’ll need to create a PayPal account if you don\’t already have one, which is unlikely if you\’ve done a lot of online shopping over the past decade.

How to use PayPal ? And Who Should Use It?

Step 1 After creating an account, you can use PayPal or a web browser to manage your transactions.

Step 2 First, to process PayPal payments, you\’ll need a business account, which you can sign up for for free.

PayPal and Venmo, while technically the same company, compete as a small business alternative that allows you to make payments online and in person. PayPal is one of the few processors that allows both businesses and individuals to accept payments, making it a popular choice for freelancers, consultants, sole proprietors, and other small businesses. PayPal Here is basically a mobile card reader and transaction processing application.

#5 Advantages of using PayPal

- It\’s also important to note that PayPal wasn\’t originally designed as a primary payment processing service for most merchant accounts. The companies offer electronic invoicing, QR code scanning, typed transactions, and account-to-account transfers, but when it comes to accepting cards, PayPal can offer more physical POS systems and virtual terminal options.

- PayPal also offers to check and debit card payments, which can be used to make purchases or withdraw money from ATMs. The Bulk Payments feature allows you to send multiple payments at the same time instead of one payment using spreadsheets or the PayPal API.

- You know perfectly well that PayPal is one of the fastest and most secure online payment platforms. One of the biggest benefits of using PayPal Business as a payment processor is the simplicity of PayPal for both you and your customers.

- Another factor in PayPal\’s broad appeal is that, unlike the vast majority of merchant accounts or payment processors, you can use PayPal as your only payment gateway or option.

Pros and Cons

Pros

- The company\’s main PayPal Payments account is very easy to manage, It can send scheduled payments to employees and thus avoid having to go through an individual payment process.

- In addition, It can check online all the transfers that have taken place in recent days. With the PayPal e-commerce platform, you can process things like payments for physical goods, services, e-commerce hosting and hosting, or crowdfunding.

- At the moment, PayPal is almost ubiquitous, with PayPal currently claiming 361 million active consumer accounts and 28 million merchant accounts.

Cons

- If a traditional seller account does not offer all the features then one needs to have to pay for extras, then it exceeds the cost of using PayPal.

- Not for large enterprises in general it Fit Small businesses and recommends PayPal for handling recurring personal payments (such as events, pop-ups, and markets) or as a backup payment solution.

PayPal Pricing

PayPal Credit is a payment method that any user can access through their PayPal account. Unlike other payment methods, PayPal Credit users get special financing on purchases of $99 or more.

Another feature that makes it even more interesting is that you can make purchases and payments via bank transfer without entering your account details. Like many payment apps, you will pay fees for certain types of PayPal transactions.

Your funds will show up instantly in your PayPal account when you accept payments, and you don\’t have to worry about subscription or software fees.

PayPal Credit

You can buy and receive credit card payments just like you would with PayPal. PayPal Credit offers some special payment offers such as longer interest-free terms. PayPal also offers payment by check and debit card, which can be used to make purchases or withdraw money from an ATM.

While you can also use your bank account, debit, or credit card for transactions, PayPal credit is easier, faster, and safer. In addition to one-time purchases, PayPal is also the fastest and easiest way to make recurring payments on all monthly bills and subscriptions.

In addition to accepting payments online, PayPal can also help with a number of other transactional transactions.

If you need lower rates or a customized plan, consider using Braintree, PayPal\’s online payment solution aimed at large enterprises, PayPal\’s pricing is very straightforward, although payment processing costs are slightly higher than most traditional merchant accounts.

PayPal\’s flat rate per transaction is very transparent, allowing merchants to accurately predict monthly payment processing costs.

The cost of using PayPal to accept payments will depend on a combination of transaction fees and an additional monthly subscription fee for online card payment gateway services.

PayPal for Small business

PayPal is a great solution for small businesses because PayPal allows you to accept PayPal credit, debit, and pay-as-you-go payments in person and online with no monthly or yearly account maintenance or monthly fees and long-term contract.

PayPal\’s transaction fees are slightly higher than its competitors such as Square and Stripe, ease of use, ubiquity, and fee transparency makes it a good choice for businesses with fairly low transaction volumes.

Conclusion

Our goal here is to look at the fetures offered through PayPal, how well it integrates with other systems, and the types of credit cards they can use.It is ease to use PayPal as compared to the Merchant Accounts.

The first thing you need to know about PayPal for payments is that the money from your transactions will be available almost instantly in your PayPal account, so you can spend the amount you earn anywhere on the web that accepts PayPal or transfers funds directly to your account in the bank.

One of the best things about PayPal is that you can accept multiple payment methods at the same time – on the go, in a physical location and online, by account and through the website – and the money from all your transactions goes into your PayPal account, making it easy manage your finances.

FAQs

Chris Fryer is a seasoned leader in the logistics and supply chain industry, known for his pioneering work in integrating blockchain and AI into global supply chain solutions. With more than 15 years of experience, Chris has played a key role in transforming freight tracking, delivery processes, and overall supply chain efficiency.

His expertise lies in leveraging cutting-edge technologies to drive innovation and sustainability within the logistics sector. Through his vision, he has helped shape a future where smarter, more transparent systems enhance supply chain management across industries worldwide. Chris remains dedicated to advancing the future of logistics through continuous technological advancements.