Lendbox aims to create a single solution for all borrowers with different needs and provide them with access to investors with different risk appetites and goals. Lendbox only acts as an intermediary between the borrower and the lender, who can freely negotiate the interest rate.

Lendbox not only acts as an intermediary but also facilitates the entire P2P lending process, from attracting borrowers and lenders to raising EMI funds. One such platform that has gained some acceptance in India is Lendbox, which facilitates P2P lending on its platform.

What is Lendbox?

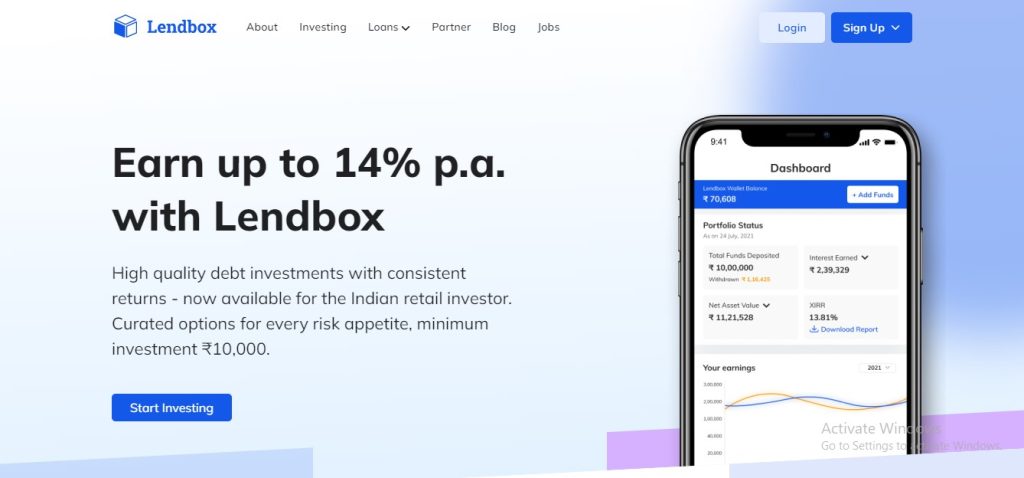

Lendbox is Lendbox\’s RBI-licensed NBFC peer-to-peer lending platform, launched in 2017, and is one of the largest P2P lending platforms in India. Lendbox is a registered peer-to-peer lending platform that has revolutionized the way reputable borrowers and smart investors/lenders connect in India.

PTPL platform Lendbox.in has signed up 2,000 borrowers and 900 lenders and provided loans worth 7.5 million in 50 days. The reaction to Total Stranges.PTPL has been overwhelming. Ekmit Singh, the 28-year-old founder of PTPL platform Lendbox.in, opened lender-borrower registration in December 2015.

#5 Key Advantages of Using Lendbox

- Lendbox does not share investor or borrower information with third-party agencies. Lendbox offers a platform where potential investors can enter into bilateral and mutually beneficial deals with pre-screened and creditworthy borrowers.

- Lendbox has partnered with some reputable companies to offer investors low-risk investment options. By creating a favorable environment for borrowers and investors, Lendbox aims to revolutionize the personal loan market in India while providing effective alternative investment opportunities.

- According to P2P rules, Lendbox does not accept collateral from borrowers. Lendbox\’s highly trained and helpful support team is ready to help with investment decisions and risk management.

- Lendbox has dedicated account management teams, which is very responsive. One can expect to make a pretty good return on Landbox, which is more than any other investment one make.

- Lendbox is a registered peer-to-peer lending platform that has revolutionized how creditworthy borrowers and smart investors/lenders connect with each other in India. This fiscal year, Indian peer-to-peer lending companies have come together to form the P2P Lending Platforms Association, of which Lendbox is a part.

What is Peer-to-Peer Lending?

Peer-to-peer lending (P2P lending) is a unique lending method where borrowers connect with investors willing to lend money on online platforms. Online lending platforms seek to connect borrowers seeking unsecured personal loans with investors willing to offer high-return loans. P2P platforms offer unsecured loans to borrowers at higher interest rates than those offered by banks and NBFCs.

P2P lending is an alternative channel for borrowers to take out credit when they really need it and for lenders to get higher returns on their investments. Peer-to-Peer Lending (P2P) is a new financial tool that allows a person to lend or borrow money to or from other people without depending on banking channels.

Peer-to-peer lending (P2P lending) is a unique lending methodology whereby borrowers can connect with investors willing to lend them money on an online platform. Online lending platforms seek to connect borrowers looking for unsecured personal loans with investors willing to make loans with good returns.

As for the borrower, the peer-to-peer lending platform allows him to avail of instant cash loans at competitive interest rates. This also results in a nice loan/loan for individuals on Lendbox. If you decide to lend through Lendbox, you can be confident in the borrower\’s ability to repay the loan.

Higher returns for investors

P2P lending offers higher returns than traditional investment channels. The P2P lending platform offers investors the opportunity to earn higher returns than regular investments. Average interest rates on PTPL platforms are much higher than bank rates on personal loans and therefore in violation of state laws.

Try to tell borrowers. Conducting borrower due diligence remains extremely important if you have to lend on P2P platforms. Lendbox has become an investor-centric platform that helps its investors earn stable returns.

Features Of Lendbox

Lendbox offers a platform where potential investors can enter into bilateral and mutually beneficial deals with pre-screened and creditworthy borrowers. Communication between lender and borrower – Lendbox allows lenders and borrowers to send and receive offers. This also results in a nice loan/loan for individuals on Lendbox.

Earning capital in investment

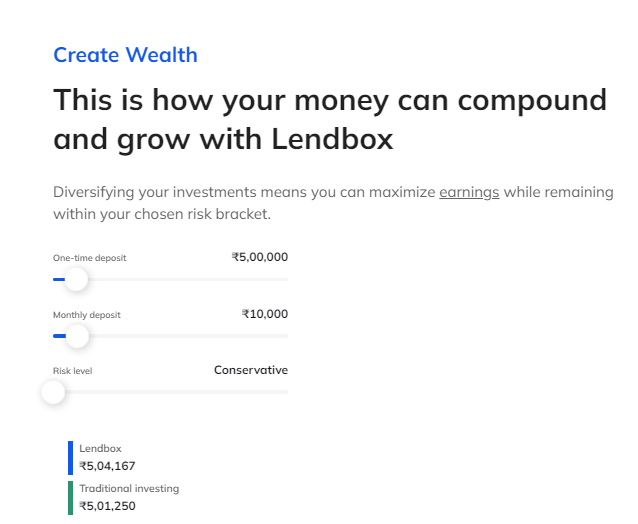

With Lendbox you can easily borrow extra money to earn a fixed income, you can also invest in multiple products and earn up to 14% per year. Lendbox has partnered with some reputable companies to offer investors low-risk investment options.

Lendbox is facing tough competition from platforms such as i2ifunding, i-lend, Faircent, OML P2P, etc. Lendbox has become an investor-focused platform, helping its investors earn stable income. Like most lending startups, Delhi-based Lendbox wanted to lend to a low-income market, a space traditional banks tend to ignore.

It has a tough verification process to ensure genuine consumers

Because the platform only admits users after their credit score has been verified, Fintech startup ensures that members can invest money with confidence knowing it will only be loaned to other people like themselves. Fintech startup suggests that those who invest in P2P loans can earn interest rates up to 9% per annum.

As for the borrower, the peer-to-peer lending platform allows him to avail of instant cash loans at competitive interest rates. P2P lending is an alternative channel for borrowers to take out credit when they really need it and for lenders to get higher returns on their investments.

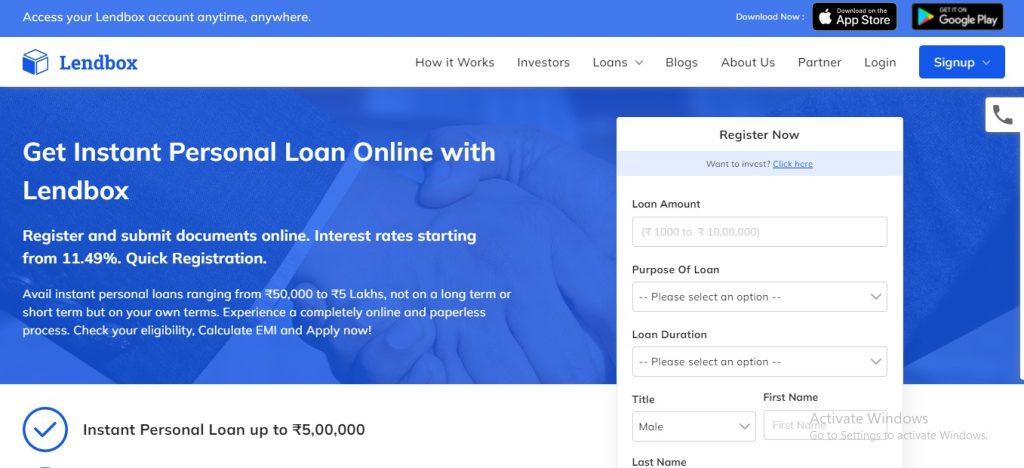

Lendbox Loans

With Lendbox, you can take out a loan even if you have a less favorable CIBIL score. With Lendbox, you can easily borrow extra money to earn a fixed income, you can also invest in multiple products and earn up to 14% per year. According to the rules, a lender cannot lend more than Rs 50,000 to the same borrower on all P2P platforms at the same time.

In December 2019, the Reserve Bank of India (RBI) allowed peer-to-peer (P2P) platform lending of 50 lakhs, up from the previous limit of 10 lakhs. Under the new RBI P2P lending rules, the exposure of one lender to the same borrower on all P2Ps must not exceed Rs 50,000 at Lendbox in Delhi.

According to the rules, a lender cannot lend more than Rs 50,000 to the same borrower on all P2P platforms at the same time.

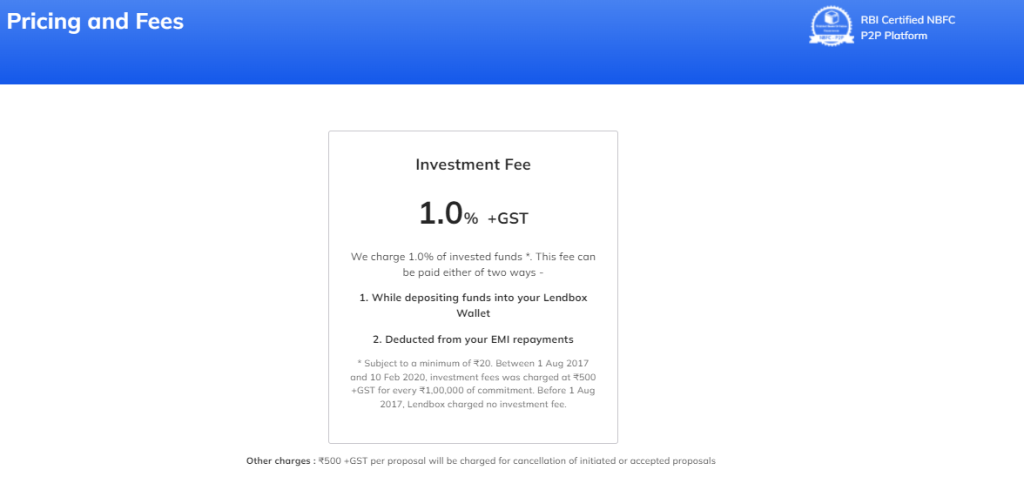

Pricing Plans

Lendbox, a fee-based company, charges the borrower a processing fee of two to six percent, depending on the interest rate. While the platform was free for investors for the first two years, the company began charging them 0.5% of the total funds they wanted to invest through the platform.

The team says they have democratized Delhi\’s Lendbox by allowing both borrowers and lenders to submit offers and expectations for loan amounts and interest.

Headquartered in Delhi, Lendbox is a democratic P2P platform that connects borrowers with investors. Lendbox provides services through peer-to-peer lending and institutional investors. Lendbox is an intermediary that provides a public platform for its P2P lending members.

Is P2P Lending a Good Way To Make Money?

P2P lending is a system where individuals and small businesses can borrow money from other individuals or small businesses without using a bank as an intermediary. According to P2P rules, Lendbox does not accept collateral from borrowers.

The platform has already registered 2,000 borrowers and 900 lenders and provided loans worth 75 lakhs in 50 days. Now the popularity of ideal strangers is growing. PTPL has attracted the attention of the banking regulator. Reserve Bank of India (RBI) Deputy Governor R. Gandhi said the regulator is looking into peer-to-peer lending.

There are some P2P platforms that are not registered with the RBI and they require guaranteed returns on loans either through ads or through their websites. Generally, the people who take out loans on P2P platforms are the ones who don\’t receive loans. in banks due to a low credit profile or very low income.

Pros and Cons

Pros

- Dozens of borrowers like have found relief in the platforms, by raising money from complete strangers.

- Lendbox is the practice of lending money on a large scale between people online. According to PTPL coordinators, these terms have helped the platforms wean hundreds of borrowers away from the bank\’s lending pool.

- Lendbox not only acts as an intermediary but also facilitates the entire P2P lending process, from attracting borrowers and lenders to collecting EMI.

Cons

- They do not have a good customer service.

Conclusion

Lendbox, situated in New Delhi, India, is a major peer-to-peer lending platform. Getting in meetings with different lenders and borrowers in this expanding worldwide industry is difficult, which is where Lendbox comes in. it is a credit-verified borrowers\’ online Platform where potential lenders may invest.

Lendbox helps lenders with risk analysis, confirmation, fraud checks, paperwork, collections, and recovery. PTPL coordinators, these conditions have helped PTP platforms wean hundreds of borrowers from the bank\’s credit pool.

Typically, people who take loans on P2P platforms are those who do not get loans from banks due to poor credit history or very low income. Dozens of borrowers have found relief in PTPL platforms, raising money from complete strangers. PTPL is the practice of lending money on a large scale between people online.

FAQs

Chris Fryer is a seasoned leader in the logistics and supply chain industry, known for his pioneering work in integrating blockchain and AI into global supply chain solutions. With more than 15 years of experience, Chris has played a key role in transforming freight tracking, delivery processes, and overall supply chain efficiency.

His expertise lies in leveraging cutting-edge technologies to drive innovation and sustainability within the logistics sector. Through his vision, he has helped shape a future where smarter, more transparent systems enhance supply chain management across industries worldwide. Chris remains dedicated to advancing the future of logistics through continuous technological advancements.